child tax credit 2022 extension

2022 Child Tax Credit. You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021.

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

The enhanced Child Tax Credit payments where distributed last year from July through December.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/23423480/GettyImages_1358862098.jpg)

. T he expanded Child Tax Credit came to the aid of many households in the United States during the COVID-19 pandemic but the boosted payments had to come to an end at the start of 2022 after it. The TCJA made 1400 per child of the credit refundable so that if a taxpayer owed less than the amount it would be added to their tax refund. While the bill received approval from.

As part of the American Rescue Act signed into law by President Joe Biden in March the child tax credits were expanded to up to 3600 per kid from the previous 2000. How much have gas prices increased in 2022. Fri 18 Mar 2022 0800 EDT Last modified on Fri 18 Mar 2022 1159 EDT.

Child Tax Credit extension. Previously the credit was 2000 per child under the age of. As of right now the Child Tax Credit will return to the typical amount 2000 per dependent up to age 16 for the 2022 tax year and there will be no advance payments offered to families.

Now if the current payment amounts do not pass in Congress moving forward eligible parents can only receive a once-a-year maximum credit per child come tax time -- 1000 for. 10 hours agoThese benefits will receive the payments. The Child Tax Credit Update Portal is no longer available.

Eligible parents can receive 3600 for each child under 6 and 3000 for each child under 17 on their 2021 tax returns which are due April 15 2022. Here is what you need to know about the future of the child tax credit in 2022. The Tax Cut and Jobs Act TCJA made 1400 per child of the credit refundable.

Democrats have a razor-thin margin in the Senate remember and needed. The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17. But without intervention from Congress the program will instead revert back to its original form in 2022 which is.

And specifically the extension of the expanded child tax credit. Tax Changes and Key Amounts for the 2022 Tax Year. Democrats are hoping to get an extension of the changes through 2022 as well.

Budget restraints only allowed the credit revamp to be temporary. Income-related Employment and Support Allowance. Democrats in Congress last March approved an expansion of the Child Tax Credit that ran from July through the end of 2021.

The enhanced child tax credit may expire in 2022 yielding a smaller financial benefit for parents. On the 15th of each month. Be your son daughter stepchild eligible foster child brother sister.

Parents with higher incomes also have two phase-out schemes to worry about for 2021. How Expansion Could Eliminate Poverty for Millions. Government disbursed more than 15 billion of monthly child tax credit payments in July to American families.

For parents who opted out of the advanced child tax credit payments in 2021 they will be able to claim the full credit if they qualify on their 2021 tax return. Between July and December the expanded child tax credit provided parents a cross the United States a small financial reprieve from the pandemics economic turbulence. A one-year extension was included in the Build Back Better bill.

Child Tax Credit. However many want it to be made permanent eventually. The child tax credit isnt going away.

You can claim the Child Tax Credit for each qualifying child who has a Social Security number that is valid for employment in the United States. The boosted Child Tax Credit did so much good that lawmakers initially sought to make it permanent. Eligible families will receive 300 monthly for each child under 6 and 250 per older child.

To be a qualifying child for the 2021 tax year your dependent generally must. President Biden then settled on a one-year extension for 2022 and wrote that language into his. Who is eligible to claim the 2022 Child Tax Credit.

Citing a difference in helping child poverty President Biden wants to continue the child tax credit CTC payments. During 2021 the tax credit reached 2000 per child under 17. The first one applies to the extra credit amount added to.

April 25th 2022 at 604 PM. New research shows a permanently expanded child tax credit. The new measures created an Enhanced Child Tax Credit.

Be under age 18 at the end of the year. Was largely responsible for the death of the child tax credit extension four months ago now. The Biden administration originally proposed extending the payments through 2025 but that proposal was reduced to just one additional year.

THE child tax credit payments have helped millions of Americans financially in 2021 but some are wondering if they will continue beyond this year. But that haircut may not be the last. 2021 Tax Filing Information Get your advance payments total and number of qualifying children in your online account and in the Letter 6419 we mailed you.

The program extended payments of 250-per-month for children ages 6. If the taxpayer owed less than the amount it will be added to their tax refund as Additional Child Tax Credit ACTC. The good news is.

President Bidens BBB Build Back Better plan aims to extend child tax credit payments through 2022.

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

Child Tax Credit 2022 Will Ctc Payments Finally Be Extended Marca

Is The Enhanced Child Tax Credit Getting Extended This Year Here S The Latest Cnet

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

/cdn.vox-cdn.com/uploads/chorus_asset/file/23392681/1235261204.jpg)

Why Did Congress Let The Expanded Child Tax Credit Expire Vox

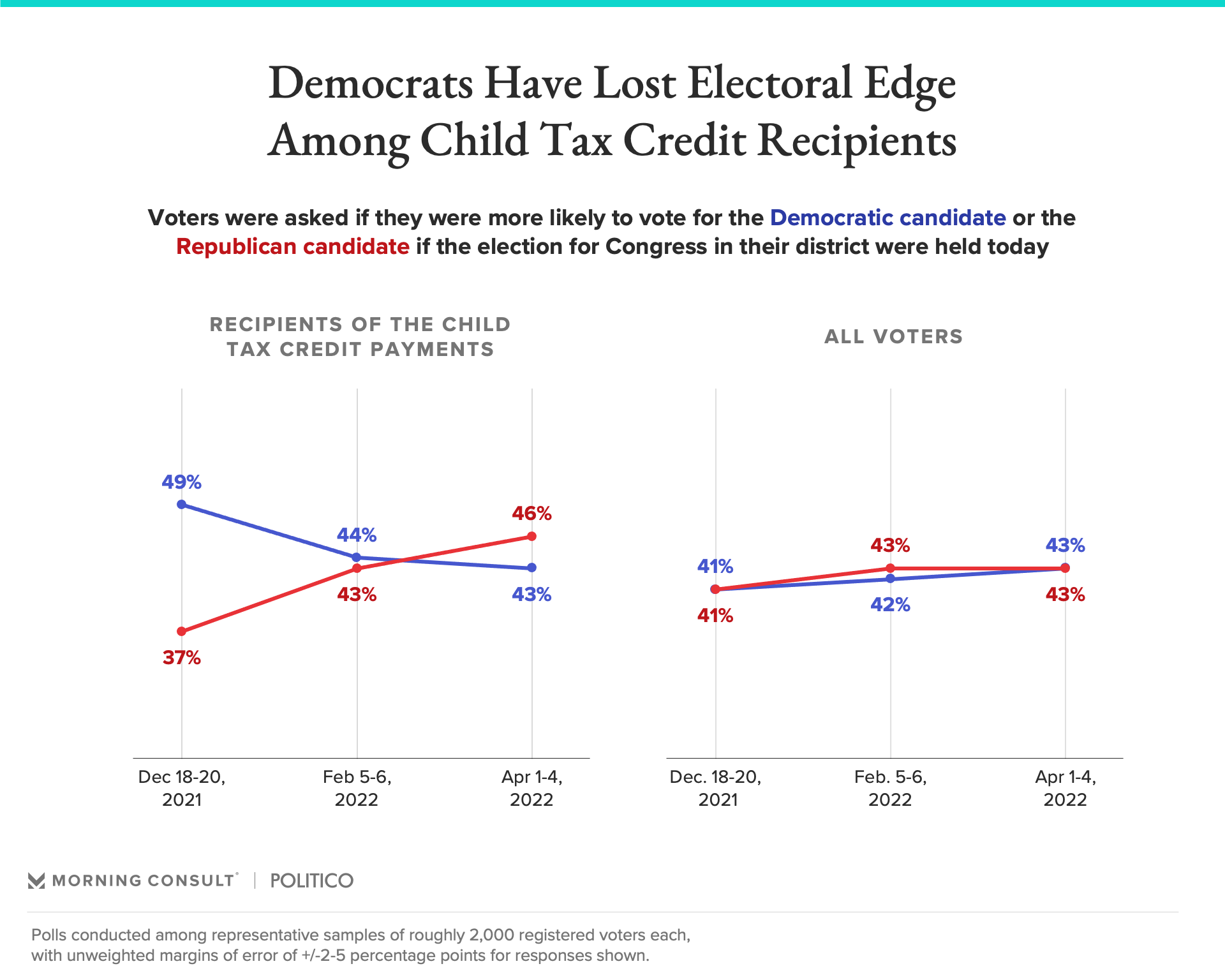

Republicans Favored To Win Senate Among Child Tax Credit Recipients

The Monthly Child Tax Credit Payments Are Done Here S What Will Replace It Fortune

No More Monthly Child Tax Credits Now What

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

The Expanded Child Tax Credit Briefly Slashed Child Poverty Npr

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Child Tax Credit Schedule 8812 H R Block

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/23423480/GettyImages_1358862098.jpg)

Will There Be An Expanded Child Tax Credit In 2022 Vox

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

The Uphill Battle To Resurrect The Us Child Tax Credit That Lifted Millions From Poverty Biden Administration The Guardian